What’s Included in PHLY’s Brewery Insurance Program?

The art and craft of brewing beer can be deeply rewarding but also increasingly fraught with pressures and risk. As rents climb and drinking habits shift, craft brewery closings outpaced openings in 2024. On top of that, lurking threats such as faulty wiring, a batch of bad bottles, or a customer who drives home after sipping too many IPAs can all threaten to undo years of investment — and a brewery’s hard-earned reputation.

Protecting against these looming risks can feel like one more item on a craft brewery’s already endless to-do list, but proactively managing brewery safety is critical. Here are three areas where establishing solid processes and procedures, as well as establishing a craft brewery insurance program, can help a craft brewer weather whatever the business throws at them.

A Safer Taproom: Serve Responsibly to Reduce Liability

The Risk: An overserving incident results in a costly lawsuit. Dram shop laws in most states can hold bars and breweries liable if they overserve alcohol to guests who are visibly intoxicated. Just one incident can result in tens of thousands of dollars in damages.

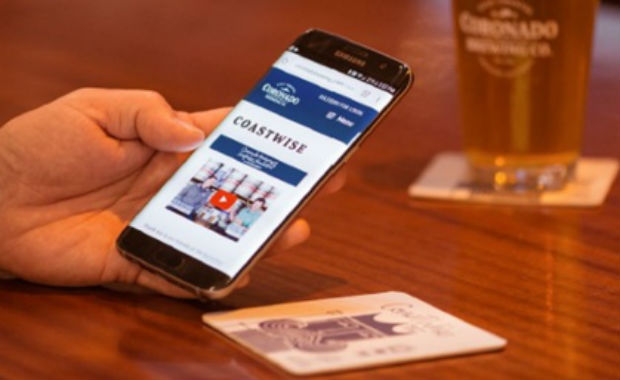

The Fix: Train staff how to safely serve alcohol and help intoxicated guests get home safely. Beer can sometimes seem like the less potent, more harmless cousin to wine and cocktails, leading some imbibers to easily exceed their limit. Team members should be trained in how and when to check IDs before even touching a tap. Establish and communicate clear policies for cutting off service in the tasting room or festival bar, and keep a list of taxi and ride-share providers in the area. Brewery owners should always maintain an incident log and archive video surveillance in case it’s needed later. Above all, have an adequate liquor liability policy in place that extends off-premises, where the majority of injuries can occur.

Brew Quality: Prevent Contamination and Recalls

The Risk: A spoiled batch of beer or compromised packaging can lead to a costly recall. Lawsuits abound due to cases of cross-contamination or dangerous re-fermentation, such as the case brought by a New York City barback after a bottle of Corona beer exploded in his hands. A year later, Stella Artois issued a recall due to the potential for broken glass in some of its bottles.

The Fix: Develop solid Standard Operating Procedures (SOPs) for every stage of production, from brewing to storage, delivery, and packaging. While the world’s largest breweries can likely absorb the damages from unanticipated accidents, they could be ruinous for nano- or microbreweries. Regularly conduct quality testing throughout the production cycle and have a product recall plan in place that includes crisis management resources.

Nonflammable: Proactively Manage Fire Hazards

The Risk: High-temperature brewing, flammable chemicals, grain dust, or contractors can expose brewhouses to unique fire risks. In 2025, for instance, a fire at Ohio’s Rocky River Brewing Company caused firefighter injuries and $3 million in damages. The cause: A construction crew working on the brewery’s roof.

The Fix: Install and maintain adequate equipment, sensors, and fire suppression systems. Alarms and sprinkler systems should be customized for your unique brewing setup. Regular inspections of equipment, pipes, wiring, and ingredient storage are critical for preventing fires, as are strict house rules to control grain dust. A sensor system can alert your team to equipment problems before they occur. Business interruption insurance coverage can provide disaster protection.

A Safer Brewhouse Is a Long-Lasting One

Proactive brewery safety from opening day on is one of the smartest investments a brewery owner can make. As a longtime insurance partner to the brewing industry, Philadelphia Insurance Companies (PHLY) understands the unique risks faced by breweries, and we’ve crafted an industry-specific policy that covers a spectrum of risk, from liquor liability coverage to insurance for pressure vessels, chemical storage, and product recalls. Find out more about how our craft brewery insurance program can keep your investment and your craft safe.

Be the first to comment