Having your brewery stand out requires more than just another IPA or barrel-aged beer on tap. Forward-thinking breweries are realizing that to capture new consumer bases, they must look beyond what’s available in a pint glass right now and embrace innovation that challenges traditional definitions of a craft brewery’s product portfolio, regardless the size of the brewhouse.

Whether it’s 49th State experimenting with sake- and koji-fermented beverages, Holidaily carving out a niche as a dedicated gluten-free brewery, Paskenta Mad River highlighting indigenous ingredients through distinct seltzer flavors, or Mason Ale Works being a family of brands that are building crossover appeal with its cider and spirits additions, these companies look to prove that creativity and adaptability are essential as a part of a craft beer portfolio.

The future could belong to those willing to brew beyond a basic beer lineup.

49th State Brewing — Sake-influenced Products

Anchorage may be closer to Tokyo than it is to most major American cities, and 49th State Brewing is leaning into that Pacific connection with new approaches to fermented beverages.

“Our brewery’s largest beer style is Lager beers,” said founder and CEO David McCarthy. “We have four brewpubs in Alaska where the dining experience has a heavy focus on Alaska seafood. That food affinity led to a dynamic marriage blending premium rice grains for these dynamic Rice Lagers.

“Sake and rice Lagers naturally work with those foods. So, we decided to apply our expertise with lagers to these rice beer styles and make a pairing that exceeds expectations.”

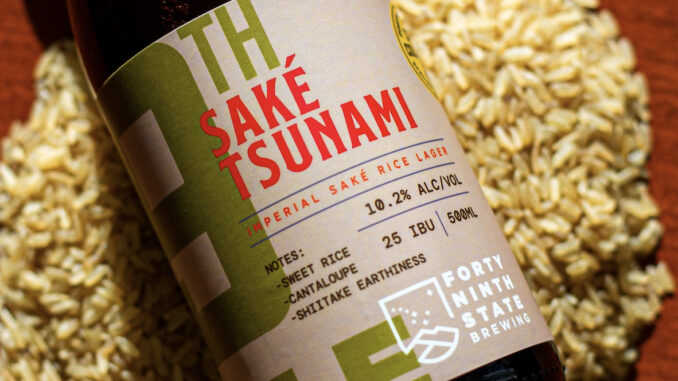

That approach has led to Amarachi Rice Lager, brewed with flaked jasmine rice and an Amarillo–Sorachi Ace hop blend, and Sake Tsunami, a 10% hybrid made with sake koji spores and Lager yeast. McCarthy said the brewery’s location and its ties to Asian food culture made experimenting with rice a natural extension of its brand.

“We are connected to the Pacific and cultures that are built around rice consumption,” he said. “Anchorage is geographically closer to Asia than most US cities.

“The culture of rice in Asia and their proximity lends to working with rice. There’s a natural affinity for these beers.”

The push into rice beers began in the brewery’s Liquid Lab, where R&D brewer Rafael Gonzalez Mosqueda said curiosity and supplier innovation opened the door.

“Just trying to get more exciting products out, more than anything,” he said. “Suppliers had new offerings, like pre-cooked rice and hop blends. That opened the door for Rice Lagers and unique styles.”

Sake Tsunami, he added, came from noticing few breweries were willing to experiment with sake yeast.

“Only one Japanese brewery I knew of had tried something similar,” he said. “It felt like an opportunity to create something unique.”

Experimentation came with challenges. Rice requires higher gelatinization than barley, making brew days long and labor-intensive without a rice cooker. Gonzalez Mosqueda also had to learn sake brewing methods to guide the process, eventually balancing enzymatic power with six-row barley and fine-tuning fermentation temperature and yeast management to shape the beer’s character.

While the initial Sake Tsunami offered a bold and distinctive product, the team saw an opportunity to create a lighter, more approachable option.

“We wanted a lighter, more crushable summer option for the rooftop pub,” Gonzalez Mosqueda said.

The project started with premium Koshihikari rice but shifted toward jasmine and flaked rice for both cost efficiency and consistency.

“They are profitable in the taproom setting due to high visitor traffic,” he said. “We needed to adapt ingredients away from costly Koshi Hikari to maintain margin.”

For 49th State, the balance between novelty and tradition is intentional. Gonzalez Mosqueda described the Amarachi Rice Lager as an authentic take on Japanese-style lagers with a subtle creative twist, while Sake Tsunami remains a passion project aimed at offering something rarely seen in the US market.

Both beers, he noted, fit the broader trend of breweries exploring alternative grains as climate change and supply shifts push the industry to reconsider its reliance on barley.

“Adjuncts may become essential for sustainability and farmer economics,” he said.

That mindset extends beyond rice. The brewery is also developing seltzers with a focus on flavor, experimenting with honey beers, mead hybrids, and collaborations with international brewers.

Cider has also entered the mix with The Alaska Reserve Cider, made from Alaskan apples.

“We’re always looking to push boundaries of ‘beyond beer,’” Gonzalez Mosqueda said.

For McCarthy, those explorations are more than experiments. They tie back to how 49th State aligns its products with its location, culture, and dining experience.

“This mixed fermentation with premium rice created brews that were an incredible experience for guests coming to Alaska for the world-renowned seafood,” he said. “There’s a natural affinity for these beers.”

Holidaily Brewing — Gluten-Free Products

When Karen Hertz founded Holidaily in 2016, she wasn’t trying to create a novelty beer or capitalize on a fleeting trend. Instead, she set out to address what she called “a glaring gap in the market” — a lack of safe, high-quality craft beer for people with celiac disease or gluten sensitivity.

“People with celiac disease or gluten sensitivity were largely excluded from the craft beer experience,” Hertz said. “Rather than treating gluten-free beer as a compromise, we built Holidaily to prove it could be bold, flavorful, and worthy of the craft label.”

That decision now positions Holidaily one of the largest dedicated gluten-free breweries in the country, a category with relatively little competition but rising consumer interest. Hertz said most gluten-free options on shelves when she launched were either gluten-reduced (which are not safe for all consumers) or lacked the complexity craft drinkers expect.

“We saw an opportunity to elevate the category by using 100% gluten-free grains like millet and buckwheat, and applying rigorous brewing techniques to create delicious craft beer,” she said. “Competitors weren’t investing in this niche with the same level of innovation, care or creativity.”

That level of commitment required significant upfront investment. Holidaily operates in a fully dedicated gluten-free facility, a move Hertz said was necessary to avoid cross-contamination and establish credibility.

“The biggest hurdle was ingredient sourcing and cross-contamination risk,” she said. “We had to build a dedicated gluten-free facility, ensuring zero cross contamination and work closely with suppliers to ensure every input met strict standards.

“Regulatory-wise, labeling and certification required diligence, but it also became a point of pride. Our beer isn’t just labeled gluten-free; it’s officially certified gluten-free, which reinforces our commitment to quality and transparency.”

Securing a reliable supply chain became another cornerstone of the business. Millet and buckwheat are not staples in most breweries, so Holidaily forged relationships with specialty suppliers and leaned on long-term contracts to manage volatility.

“These ingredients are more volatile and expensive, but we manage risk through long-term contracts and batch testing,” Hertz said. “It’s a challenge, but it’s central to our mission.”

From a market positioning standpoint, Holidaily has worked to move gluten-free beer away from being perceived as a dietary concession and toward being a desirable product in its own right.

“We position it as a lifestyle draw with roots in brewing tradition,” Hertz said. “Our audience includes gluten-free consumers, but also craft beer lovers who appreciate innovation and great tasting beer.

“We’ve found success in marketing it as ‘great beer that happens to be gluten-free,’ rather than leading with the dietary angle.”

That positioning has paid off with profitability and distribution so far across 11 states. Hertz credits both the financial returns and the brand narrative.

“They’re profitable, especially as awareness grows,” she said. “But they also serve as a powerful brand story — one of inclusion, resilience, and flavor-first brewing.

“Taproom traffic, retail expansion, and community engagement all benefit from this narrative.”

For Hertz, the brewery’s mission is not to push beyond beer, but to redefine it for a broader audience.

“I hate to ever say we’re beyond beer because we really are beer,” she said. “Just brewed with innovation.”

Paskenta Mad River Brewing — Indigenous-Ingredients in Products

When Mad River launched its Undammed hard seltzer during the pandemic, the timing looked opportunistic. Seltzers were exploding in popularity, and consumers were reaching for alternatives beyond beer. But for the Native American–owned brewery in Blue Lake, California, the decision was less about chasing a fad and more about expanding the portfolio with a product that could stand on its own while tying into a broader message about water and sustainability.

“It was during the pandemic, and seltzers were just upticking really fast,” said General Manager Linda Cooley. “White Claw was one of the only games out there, and we were looking at expanding our portfolio at a time when there was a lot of the unknown. The fight for water and Indian country across the United States was just at a peak, and it felt like the perfect moment. The product came together just as the largest dam removal in history was announced. It was amazing timing.”

Undammed debuted with a huckleberry flavor infused with Perle hops, a deliberate step away from the cherry and mango flavors saturating the market. The brewery leaned on indigenous ingredients to stand apart from national competitors.

“We wanted to do a flavor that was outside of the ordinary,” Cooley said. “Huckleberry was local, it was indigenous, and it really connected to our identity as a company.”

Mad River Director of Operations, Kevin Montgomery, said the technical process was less about reinventing brewing and more about adapting it.

“It was pretty much designed after just brewing beer,” he said. “You heat up cane sugar, add hops, pump it into a fermenter, and let your house yeast do the work. We added hibiscus flowers during fermentation to round out the huckleberry flavor.

“At first it was trial and error, but we dialed in the nutrients to get the fermentation to finish more like a typical beer.”

READ MORE: Did Alternate Ending Create a New Style of Lager?

That trial and error paid off, allowing Mad River to transition Undammed from taproom tests to canned distribution when on-premise sales were uncertain.

“We knew we wanted to move to cans because the taproom wasn’t consistently open,” Cooley said. “We tested multiple flavors and landed on huckleberry as the one to push into packaging. We also decided on larger cans. I’m a beer drinker, and if I’m drinking a seltzer, I want a full drink. I hated going to buy ‘baby cans.’”

The seltzer line has endured well past the initial boom. While consumer demand has cooled compared to its peak, Mad River still sees consistent sales.

“The moment we think it’s dead and gone is the moment we get crazy amounts of requests for it,” Cooley said. “It’s not as big as it once was, but it hasn’t gone away. Our locals are used to this product now, and I don’t think we’re going to get rid of it anytime soon.

“There’s a category of people that want something different.”

For Mad River, seltzer fills a space cider often cannot.

“We have ciders from other local businesses, but cider can be really sweet with a lot of sugar in them,” Cooley said. “Seltzer really fills that category. It’s also gluten-free, with a smoother finish because of the hibiscus. It’s not overly forward or aggressive, but palatable.”

Marketing manager Jessica Carenco said the product has become a cornerstone in telling the brewery’s story.

“With every product, there’s evolution,” she said. “The story builds as each consumer has their own experience with it. It’s an invitation to bring others into that story, and in that sense, it has been a novelty.

“But it was always intended to be an extension of the Mad River portfolio.”

That portfolio approach has also sparked innovation beyond seltzers. Montgomery said working through the fermentation challenges of sugar-based beverages forced him and the brew team to think differently.

“There’s not much research out there about seltzers, so you have to dig through Reddit threads and experiment,” he said. “It takes everybody out of their comfort zone, makes them problem-solve, and think about how drinking habits are changing.

“Younger generations are going for low-ABV and nonalcoholic options, so we have to keep our finger on the pulse. At the same time, we stick to our roots of making good beer.”

Even as national brands scale back their seltzer ambitions, Mad River sees Undammed as a long-term piece of its business. The product has margins stronger than guest taps, appeals to consumers outside traditional beer drinkers, and carries a message the brewery is proud to stand behind.

“People are happy to support it because we all need water,” Cooley said. “It was a celebratory package, and it continues to be one of those products people are proud to buy. For us, it’s an option that’s house-made, and it keeps awareness front and center.”

Mason Ale Works — Diversification with Cider, Spirits & More

When Grant Tondro looks back at the past decade of building Mason Ale Works and its sister brands, he doesn’t pretend the path was carefully mapped. Much of the group’s current beverage structure, which now includes Eppig Brewing, Beer Zombies, Castellum Ciders, Old Harbor Distilling, Swell Craft Soda and Second Chance Brewing, came through opportunity and adjustment more than long-term planning. But once the pieces were in place, the strategy became clear.

“I would be remiss if I didn’t admit that it was not part of the original strategy, but more something that we kind of realized along the way,” Tondro said. “It’s so much easier to be profitable when you have scale.”

That scale is now the foundation of a diversified beverage company that is finding ways to reduce overhead, stretch resources and reach wider audiences. For Tondro, the realization came when he saw how multiple brands could share the same production facilities, sales staff and distribution channels while still maintaining distinct identities.

“At 3-4,000 barrels a year, you’re a decent size, small craft brewery, but you’re in this really sort of awkward place where in order to grow more than that, you need to invest in a lot of people, but you don’t have the revenue for those people,” he said. “So what we started realizing, because all of a sudden you kind of accidentally had this portfolio of three brands, was hey, all three of these brands can exist with one sales rep, with one production facility, with one person spearheading accounts. They can all benefit from this shared cost.”

That structure also gave the group more flexibility in how it approached the market. Some accounts had no interest in beer but wanted cider. Others were excited about soda, or the distilling side.

“We realized, okay, there can be this full spectrum of brands that you’re presenting to people, and somewhere within there you’re gonna have a Swiss Army lifestyle solution for them,” Tondro said.

One of the biggest surprises was the success of Swell. Using the same equipment that often sat idle, the company revived an old bottling line and began distributing to unexpected customers, including other breweries.

“It’s been really kind of random and unexpected, but it’s been a great diversification tool for us,” Tondro said.

Castellum Cider has also become a strong growth driver, with roots in a partnership that gave the team an early look at the potential of cider revenue.

“Because we had this ownership stake, we were able to see under the hood and see the revenue potential and see how it’s in the marketplace,” Tondro said. “Surprisingly, out of all the brands in our portfolio, the two brands that are up the most percentage-wise year-over-year are Castellum and Swell.”

Managing multiple brands under one roof also benefits suppliers and distributors. Ingredient orders for grain and hops rise with each acquisition, which drives better pricing. Out-of-state distributors are able to consolidate orders across categories, saving on shipping costs and increasing efficiency. Still, diversification isn’t just about efficiency. Tondro said the company remains committed to letting each brand keep its own identity.

“We tell individual stories for each of the brands,” he said. “We would definitely want to be true to the brands that end up becoming part of the group, really celebrating the things that made them unique and make them attractive to doing some sort of deal with them in the first place.”

That balance of shared resources and individual brand identity has allowed Mason Ale Works and its family to expand without losing the elements that made them appealing in the first place. It has also opened the door to new possibilities, from canned cocktails under Old Harbor to potential forays into coffee and wine.

Be the first to comment