In recent data from YouGov CategoryView, younger U.S. adults — especially those aged 21-29 — are consuming non-alcoholic alternatives with a frequency and enthusiasm that older groups do not match, and their motivations suggest a way for how this industry needs to become in order to stay relevant.

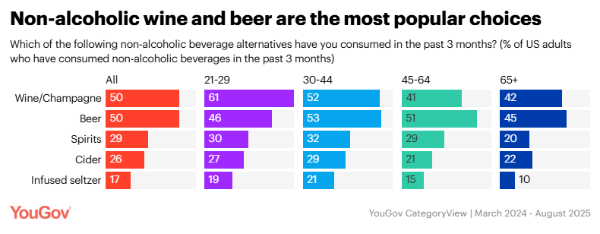

Almost a quarter (23%) of 21- to 29-year-olds drink non-alcoholic beverages several times a week, and nearly 40% show “high purchase intent” for NA drinks. Non-alcoholic wine or champagne and non-alcoholic beer each have been consumed in the past three months by about half of people who use NA beverages; younger adults gravitate especially toward wine, while NA beer is more evenly adopted across age groups.

Health is the top-cited motivator overall (about 40%), but for younger consumers availability (36%) and taste preferences (28%) are also strong. Among under-30s, avoidance of drunkenness (33%) and hangovers (26%) matter too.

Social contexts matter: many younger and middle-aged consumers report drinking NA beverages at gatherings with friends or family, after work, at events or dates. Frequency drops off sharply among older age groups.

From a craft-beer business point of view, these findings offer both a warning and an opportunity. To sustain growth (or at least not lose ground) with consumers in their 20s and 30s, breweries may need to evolve in ways hinted at by the NA trend.

One implication is that variety and innovation matter more than ever. NA beverages are not just “beer replicas” but include wine, champagne alternatives, infusions, ciders, and such. Younger consumers are trying diverse formats. If you limit yourself to standard beer styles, you risk being bypassed by drinkers who want something new or that matches different moods.

Another is that taste is non-negotiable. It’s not enough that something is NA; younger consumers will choose NA only if it tastes good. Brewers already have strength in flavor innovation; doubling down on taste in NA or low-ABV brands, and ensuring quality that rivals full-strength products, is essential.

Accessibility is also key. Young consumers care about easy availability. That could mean looking to widen retail distribution, more on-premise presence, or even finding ways direct-to-consumer channels. Your brewery may excel in taproom and community presence and extending the ease of purchase beyond that sphere could capture those “occasion” moments (such as after work, at events, while out with family/friends).

Health, sobriety, and moderation are motivators. A brewery could respond by expanding or refining low- and no-alcohol lines, making them more central to brand identity rather than being just a “side project” for the company.

Also, transparency is key. That means explaining your ingredients, calories, and processes. The younger cohort perceives risk in alcohol, not only in intoxication but health effects; and creating a trusting brand that is honest in these aspects can win loyalty.

Social settings remain important since people are choosing NA drinks in contexts tied to socializing. A brewery could lean into those settings: events, outdoor festivals, communal taprooms, partnerships, and such. Making NA options an equal part of the social experience (not just something “for the driver”) enhances inclusion.

And most NA consumers polled are light spenders. Only a small portion spend more than $100/month. Since craft beer tends to be premium-priced; the thought process is needed to balance premium with value in NA offerings. This could be done perhaps via smaller pack sizes, more affordable lines of product, or creative bundling so that trying a NA product feels low risk for the consumer.

READ MORE: Finding Success With Non-Alcoholic Options

The NA beverage boom among younger adults suggests that craft breweries wanting to retain or grow share in the 21-44 age group need to become more agile in many facets. That means offering high-quality, innovative NA/low-ABV products; making them as easily accessible as full strength; being transparent and health aware; and embedding those offerings in social, experience-based contexts. If you rely on craft beer’s traditional strengths without adapting, it may lose share to the NA alternatives that are performing precisely because they are hitting these marks.

Ways to Respond to NA Trends

- Elevate NA and low-ABV as core, not side projects. Treat non-alcoholic options as integral to your brand portfolio. Younger adults see NA as part of their lifestyle, not a novelty.

- Invest in taste innovation. Consumers under 30 will not compromise on flavor. Make sure NA products deliver the same craft quality and sensory experience as full-strength beers.

- Diversify beyond “beer replicas.” Younger consumers explore NA wine, champagne, and other alternatives. Consider cross-category experimentation — botanical infusions, hop waters, or hybrid beverages — that reflect craft values.

- Expand availability. NA adoption is strongly tied to accessibility. Push distribution into retail, restaurants, and events so NA options are present where people already gather.

- Price for inclusivity. Many NA drinkers are light spenders. Offer smaller pack sizes or mixed packs that allow trial without a large financial commitment.

- Be transparent on health. Younger adults cite health, avoiding drunkenness, and hangovers as key motivators. Highlight nutritional information, ingredients, and production processes to build trust.

- Prioritize social context. People drink NA at family gatherings, after work, and on dates. Design taproom experiences, events, and marketing that normalize NA as a full social option, not an afterthought.

Be the first to comment